E-file Manager

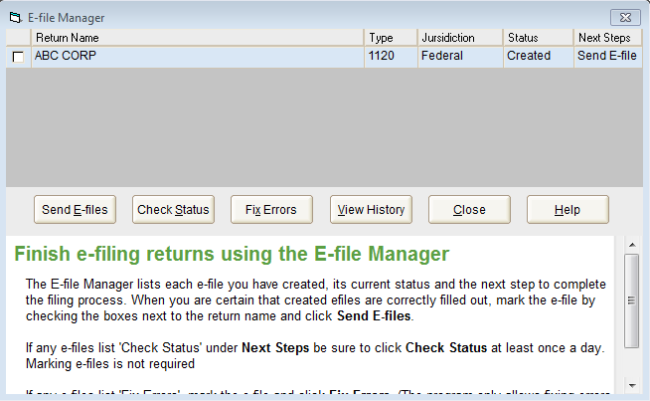

The E-file Manager organizes and tracks the status of e-files that were created from your returns.

To open E-file Manager, click the E-file menu; then, select E-file Manager.

|

Field or Button Name |

Description/Function |

|---|---|

|

Return Name |

Displays the name of the return. |

|

Type |

Displays the tax package type (such as 1120, 1120S, 1065, etc.) |

|

Jurisdiction |

Indicates the jurisdiction of the return: is it Federal, or is it for a specific state? |

|

Status |

Tells you where the e-file is in the overall e-file process. The previous screenshot shows that the e-file has been Created. For all statuses, see E-file Statuses. |

|

Next Steps |

Tells you the next step in the e-filing process. For example, the previous screenshot shows that the next step in the process is to send (or transmit) the e-file. Consequently, after selecting or marking the e-file, you would click the Send E-files button to transmit it. |

|

Send E-files button |

For the marked return, opens the E-file dialog box from which you can transmit the e-file. See Transmitting E-files. |

|

Check Status button |

For the return checked in the E-file Manager, this button opens the E-file dialog box check the status of and e-file. |

|

Fix Errors |

Opens the list of errors in the Interview portion of the screen for the highlighted return. |

|

View History |

Opens the Acknowledgement History dialog box. See Acknowledgement History. |

|

Close button |

Closes the E-file Manager. |

|

Help button |

Opens Help Central to the E-file Manager help topic. |

You can only delete an e-file from the E-file Manager if it has a Created or Rejected status. E-files with any other status cannot be deleted.

See Also: